The design software industry witnessed a momentous event when Figma officially went public in July 2025, trading under the ticker symbol “FIG” on the New York Stock Exchange. This comprehensive guide explores everything investors need to know about Figma stock, from its remarkable IPO performance to practical steps for purchasing shares through popular platforms like Robinhood.

Understanding Figma Stock: Company Overview

Figma has revolutionized collaborative design, becoming the go-to platform for millions of designers, developers, and product teams worldwide. The company reported $749 million in revenue in 2024 and $228.2 million in revenue for the first three months of 2025, with more than 13 million monthly active users on its platform.

The journey to becoming a publicly traded company wasn’t straightforward. In 2022, Adobe had agreed to acquire Figma for $20 billion, but the deal was scrapped after regulators objected. This regulatory intervention ultimately paved the way for Figma’s independent public debut.

Figma Stock Price Performance and IPO Details

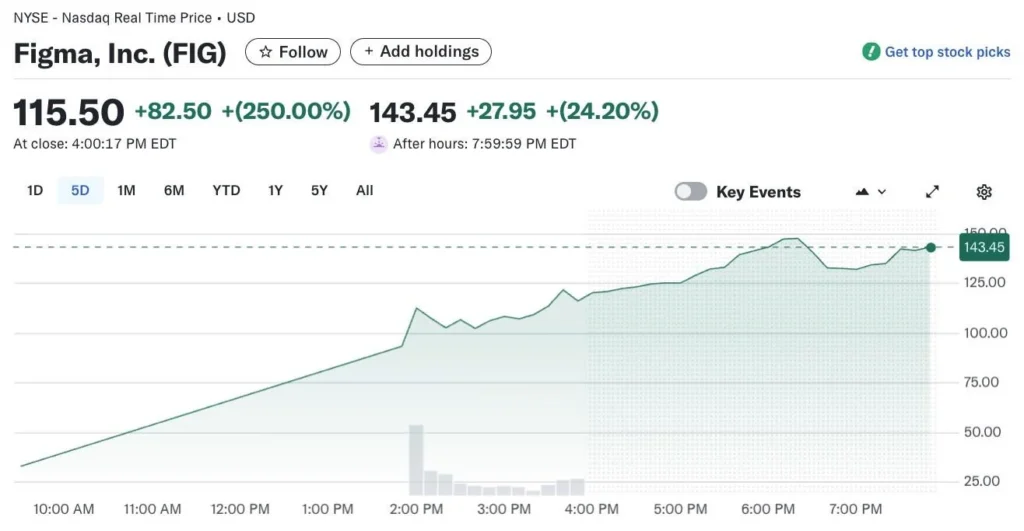

The Figma IPO date was July 31st, 2025. The deal priced at $33 per share and the first trade occurred at 1:59 pm ET at $85 per share (158% “pop”). The stock closed on the first day of trading at $115.50, up 250%.

This spectacular first-day performance demonstrates significant investor enthusiasm for the company’s prospects. The IPO pricing journey itself tells an interesting story of growing confidence:

- Initial expected price range: between $25 and $28 per share

- Revised price range: between $30 and $32 per share

- Final IPO price: $33 per share

Based on its offering price of $33 per share, Figma’s IPO valued the company at roughly $19.3 billion. However, the FIG finished Thursday with a market cap of $47.1 billion.

Figma Stock Price Reddit Discussions and Community Sentiment

The Reddit investment community has been actively discussing Figma stock since its IPO announcement. Popular subreddits like r/stocks, r/investing, and r/SecurityAnalysis have featured numerous threads analyzing the company’s valuation, growth prospects, and competitive positioning against established players like Adobe.

Key discussion points on Reddit include:

Valuation Concerns: Many Reddit users debate whether the current stock price reflects realistic growth expectations, especially given the significant first-day surge.

Growth Potential: Discussions often highlight Figma’s expansion into new markets, including developer tools and enterprise solutions, as key drivers for future growth.

Competitive Landscape: Reddit investors frequently compare Figma’s market position relative to Adobe Creative Suite and other design software competitors.

Long-term Investment Thesis: Community sentiment generally favors Figma’s collaborative approach and cloud-native architecture as sustainable competitive advantages.

How to Buy Figma Stock: Step-by-Step Guide

Purchasing Figma stock follows the same process as buying any publicly traded security. Here’s a comprehensive guide for new investors:

1. Choose a Brokerage Platform

Select a reputable brokerage that offers access to NYSE-listed stocks. Popular options include:

- Traditional brokerages (Charles Schwab, Fidelity, E*TRADE)

- Commission-free platforms (Robinhood, Webull, SoFi Invest)

- Full-service brokers for larger investments

2. Open and Fund Your Account

Complete the account opening process, which typically requires:

- Personal identification information

- Social Security number

- Employment and income details

- Initial deposit (varies by platform)

3. Research and Analysis

Before purchasing, conduct thorough research including:

- Recent earnings reports and financial statements

- Industry trends and competitive analysis

- Analyst recommendations and price targets

- Technical chart analysis

4. Place Your Order

Navigate to your brokerage platform and:

- Search for “FIG” or “Figma”

- Choose your order type (market, limit, stop-loss)

- Specify the number of shares

- Review and confirm your purchase

How to Buy Figma Stock on Robinhood

Robinhood’s user-friendly interface makes purchasing Figma stock particularly straightforward for retail investors:

Step 1: Download and Setup

Install the Robinhood app and complete the account verification process. This typically takes 1-3 business days for approval.

Step 2: Fund Your Account

Link your bank account and transfer funds. Robinhood offers instant deposits for smaller amounts, allowing immediate trading.

Step 3: Search for FIG

Use the search function to find “FIG” or type “Figma” in the search bar.

Step 4: Analyze the Stock

Review Robinhood’s built-in analytics, including:

- Current stock price and daily performance

- Historical price charts

- Basic financial metrics

- News and analyst insights

Step 5: Execute Your Trade

Choose between:

- Market Order: Buy immediately at current market price

- Limit Order: Set a specific price you’re willing to pay

- Dollar-Based Investing: Purchase a specific dollar amount rather than a set number of shares

Step 6: Monitor Your Investment

Use Robinhood’s portfolio tracking tools to monitor your Figma stock performance and set up price alerts for significant movements.

Investment Analysis: Figma Stock Fundamentals

Financial Performance

By the fourth quarter of 2024, Figma reported profits again, as it did in Q1 of 2025. Figma has also calculated its total debt to be so negligible that it reports it has none. This strong financial position provides a solid foundation for growth investments and strategic initiatives.

Market Opportunity

The collaborative design software market continues expanding as remote work becomes more prevalent and digital transformation accelerates across industries. Figma’s position as a market leader in this space presents significant growth opportunities.

Competitive Advantages

Several factors differentiate Figma from competitors:

Cloud-Native Architecture: Unlike traditional desktop software, Figma’s web-based platform enables real-time collaboration and automatic updates.

Network Effects: As more designers and teams adopt Figma, the platform becomes increasingly valuable for collaboration and sharing.

Developer-Friendly Features: Figma’s API and plugin ecosystem attract developer communities, expanding its addressable market beyond traditional designers.

Enterprise Focus: Growing adoption among large enterprises provides stable, recurring revenue streams with higher lifetime values.

Risk Factors to Consider

Valuation Concerns

The significant IPO premium and first-day surge raise questions about current valuation levels. The stock finished with a market cap of $47.1 billion, representing substantial expectations for future growth.

Competition Risk

Adobe and other established software companies continue developing competitive products. Despite the failed acquisition attempt, competitive pressure remains a significant consideration.

Market Dependency

As a relatively young public company, Figma’s stock price may experience higher volatility compared to more established software companies.

Economic Sensitivity

During economic downturns, businesses often reduce software spending, potentially impacting Figma’s growth trajectory.

Future Outlook and Growth Catalysts

Product Innovation

Figma continues investing in new features and capabilities, including:

- Advanced prototyping tools

- Developer handoff improvements

- AI-powered design assistance

- Enhanced enterprise security features

Market Expansion

Growth opportunities include:

- International market penetration

- Adjacent market expansion (presentation software, project management)

- Enterprise sales acceleration

- Small business market development

Strategic Partnerships

Collaborations with major technology companies could accelerate adoption and create new revenue streams.

Expert Recommendations and Price Targets

Financial analysts remain generally optimistic about Figma’s long-term prospects, though opinions vary on current valuation levels. Figma is only the fifth company to raise at least $1 billion in an IPO thus far in 2025, highlighting its significance in the current market environment.

Key analyst considerations include:

- Sustainable competitive advantages in collaborative design

- Strong financial metrics and debt-free balance sheet

- Large addressable market with significant growth potential

- Premium valuation requiring exceptional execution

Conclusion

Figma stock represents an intriguing investment opportunity in the rapidly evolving design software market. The company’s successful IPO, strong financial performance, and market-leading position in collaborative design create a compelling investment thesis.

However, the significant valuation premium requires careful consideration of risk tolerance and investment timeline. Potential investors should thoroughly research the company’s fundamentals, monitor competitive developments, and consider their overall portfolio allocation before making investment decisions.

Whether you’re buying through Robinhood, traditional brokerages, or other platforms, Figma stock offers exposure to the growing digital design market. As with any investment, diversification and thorough research remain essential for long-term success.

The design software industry’s continued evolution, combined with Figma’s innovative approach and strong market position, suggests the company is well-positioned for future growth. However, investors must balance growth potential against current valuation levels and market volatility risks.

For those interested in participating in Figma’s public market journey, the stock trades under ticker symbol “FIG” on the New York Stock Exchange, making it accessible through virtually any brokerage platform or investment app.